Applying for a mortgage loan can be extremely stressful, yet the process can be completed in a few easy steps. Here is a quick breakdown for beginners on how to go about applying for a mortgage loan.

Choosing a Mortgage Loan

The one advantage of taking out a loan is that there is a wide range of mortgage lenders and financing options available on the market. However, it’s essential to compare these options carefully to select the most suitable loan. Some people may want the option to pay their mortgage loan off within a particular period.

Proof of Citizenship or Identity

You will need to be to prove your identity and have proof of citizenship if you decide to apply for a mortgage loan. Most countries only allow property ownership if the buyer is a citizen of the country concerned or if there is a business agreement in place.

Most mortgage lenders will accept a passport or a driver’s licence as proof of identity or citizenship.

Proof of Reliable Income

Financial institutions may need additional documentation to substantiate a buyer’s eligibility for a loan. Finance providers will always ask for proof of income before approving a mortgage application. Bank statements are required to prove to the mortgage lender that the buyer can afford their monthly instalments.

Credit Rating

Everyone that applies for finance needs to be aware of their credit score or rating. Individuals that apply for a mortgage loan go through a credit rating check. Having a bad credit score may lead to a loan application being rejected.

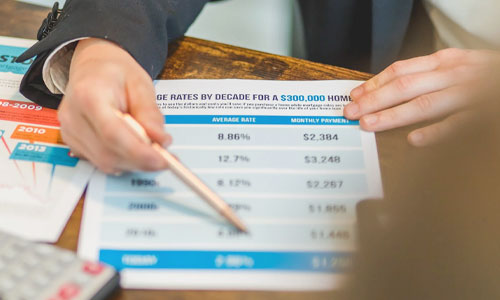

There are many other finer details about buying a property that was not discussed here, like legislative matters, interest rates on loans, and placing a sizeable deposit on the purchase of a home to avoid high-interest rates. However, these are the most basic aspects of applying for a mortgage loan.

Once all the necessary financial aspects of a mortgage application are in place, a buyer can proceed with buying the property.